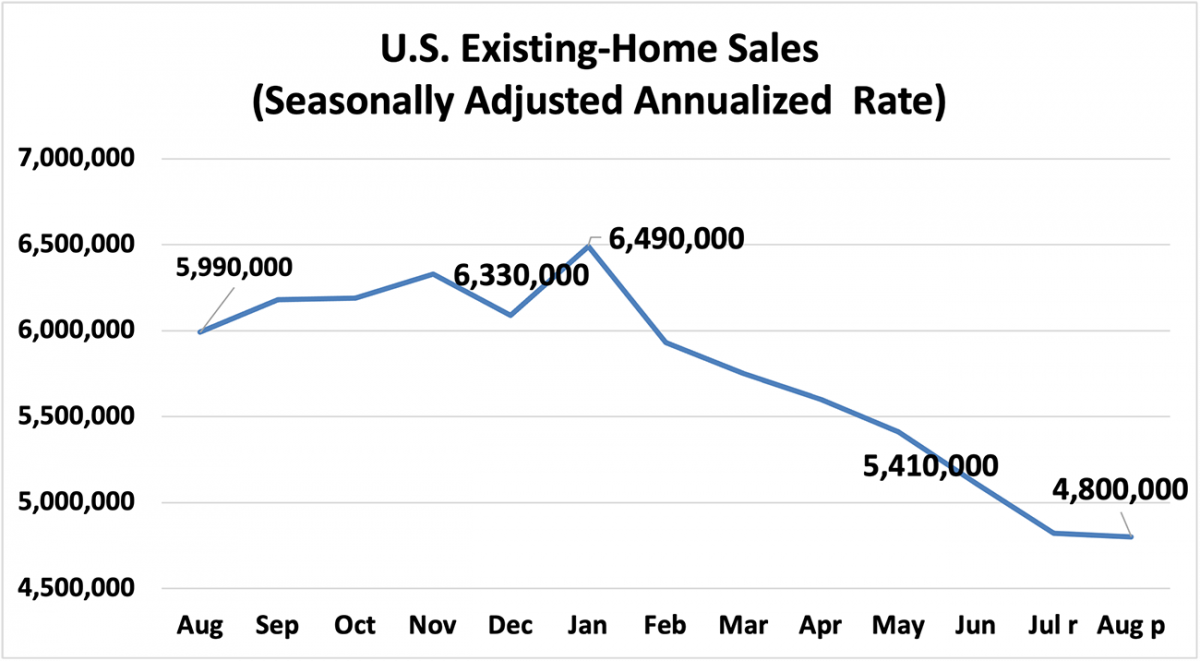

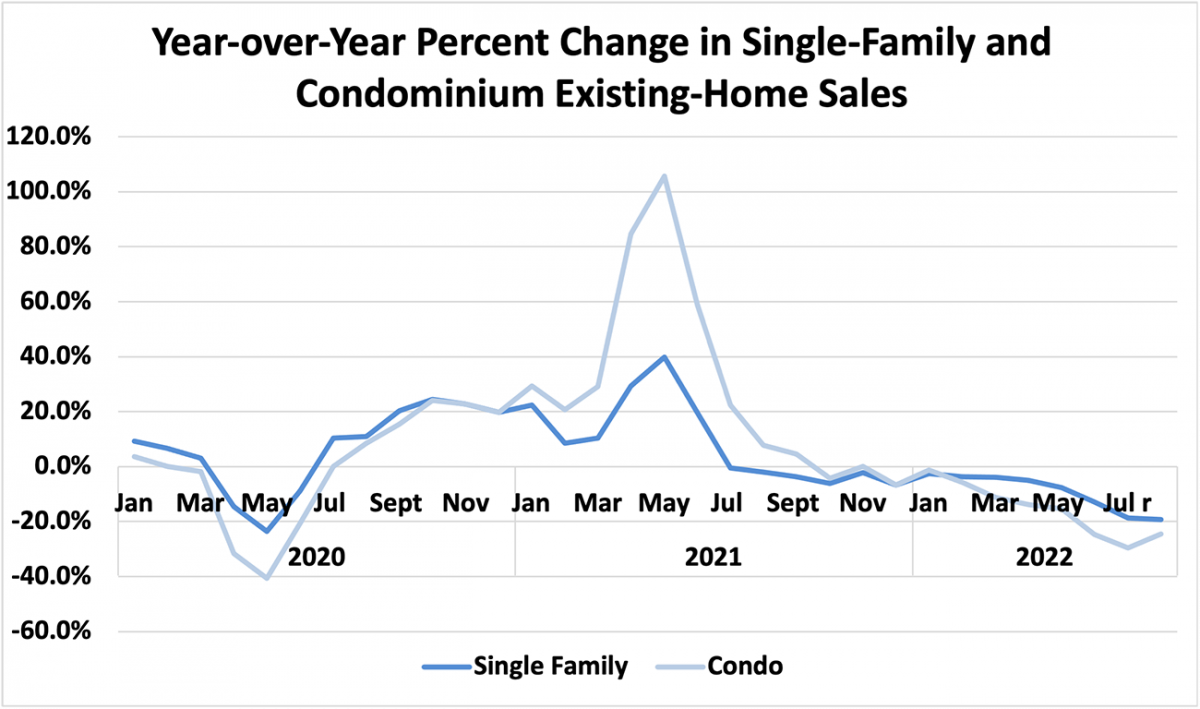

NAR released a summary of existing-home sales data showing that housing market activity this August fell modestly (0.4%) from July 2022. August’s existing-home sales reached a 4.80 million seasonally adjusted annual rate. August’s sales of existing homes declined 19.9% from August 2021. August’s sales represent the seventh consecutive month of declines, and sales were the weakest since May 2020.

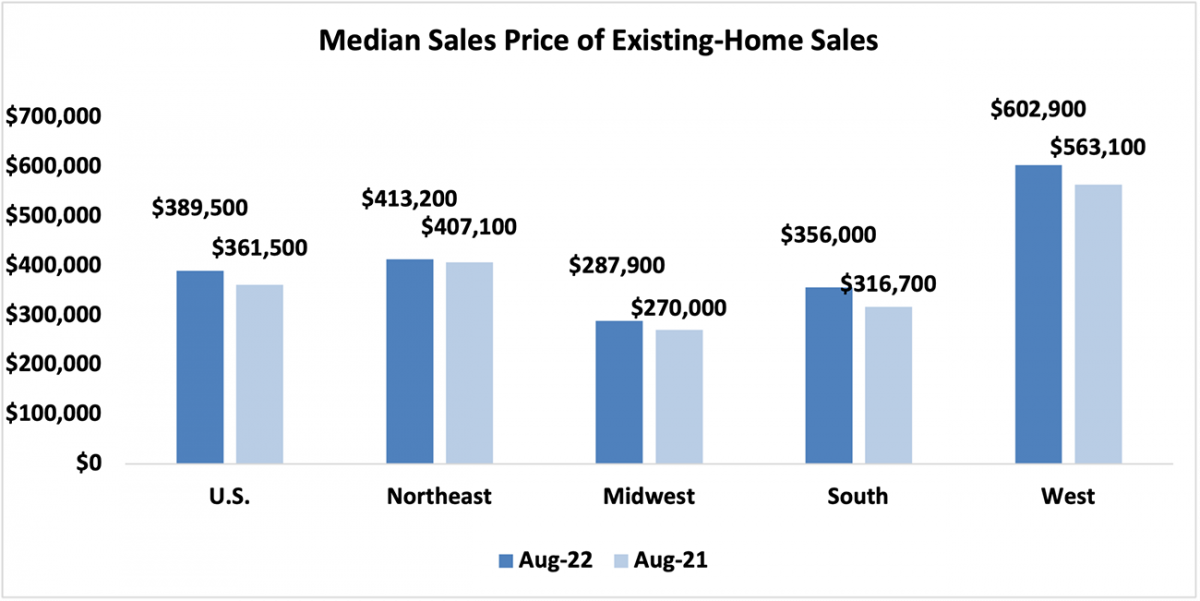

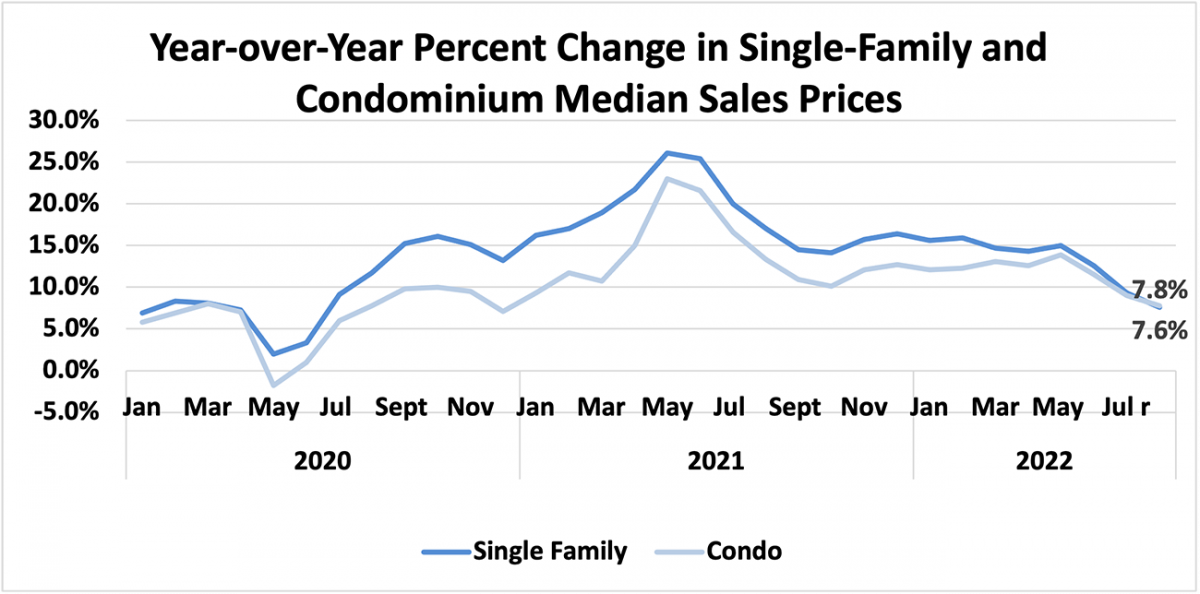

The national median existing-home price for all housing types reached $389,500 in August, up 7.7% from a year ago. Home prices have continued to climb, marking the 126th consecutive month of year-over-year gains.

Regionally, in August, all four regions showed strong price growth from a year ago. The South had the most significant gain of 12.4%, followed by the West, with an incline of 7.1%. The Midwest had an increase of 6.6%, followed by the Northeast, with the smallest price gain of 1.5% from August 2021.

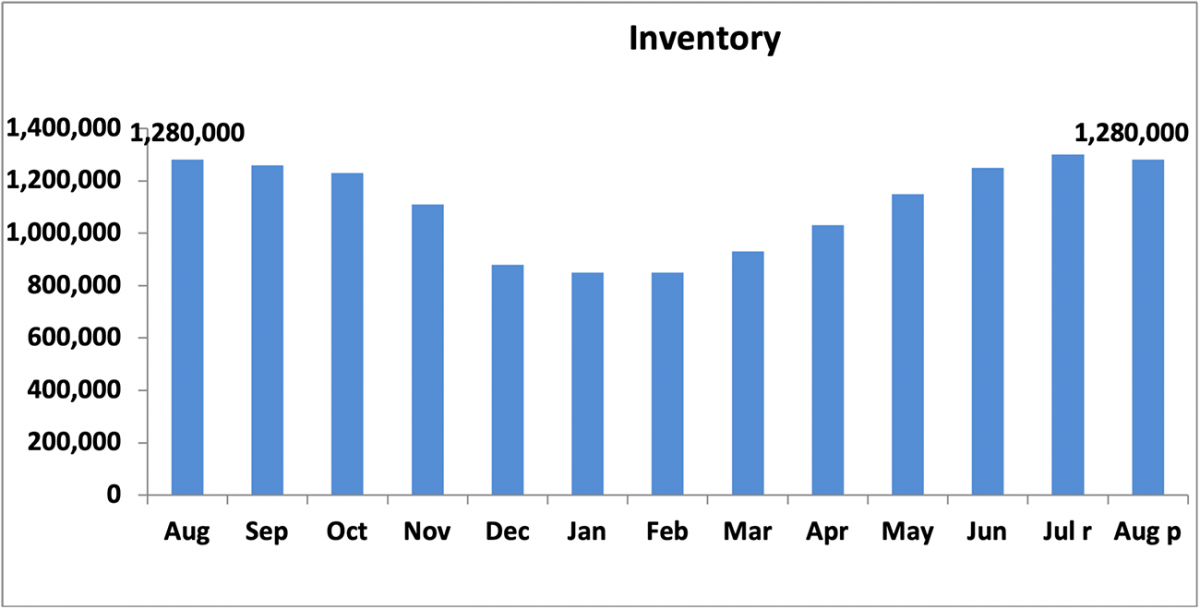

August’s inventory of unsold listings, as of the end of the month, fell 1.5% from last month, standing at 1,280,000 homes for sale. Compared with August 2021, inventory levels were flat. It will take 3.2 months to move the current inventory status at the current sales pace, well below the desired pace of 6 months.

Demand remains strong as home buyers are snatching listings quickly off the MLS, and it takes approximately 16 days for a home to go from listing to a contract in the current housing market. A year ago, it took 17 days.

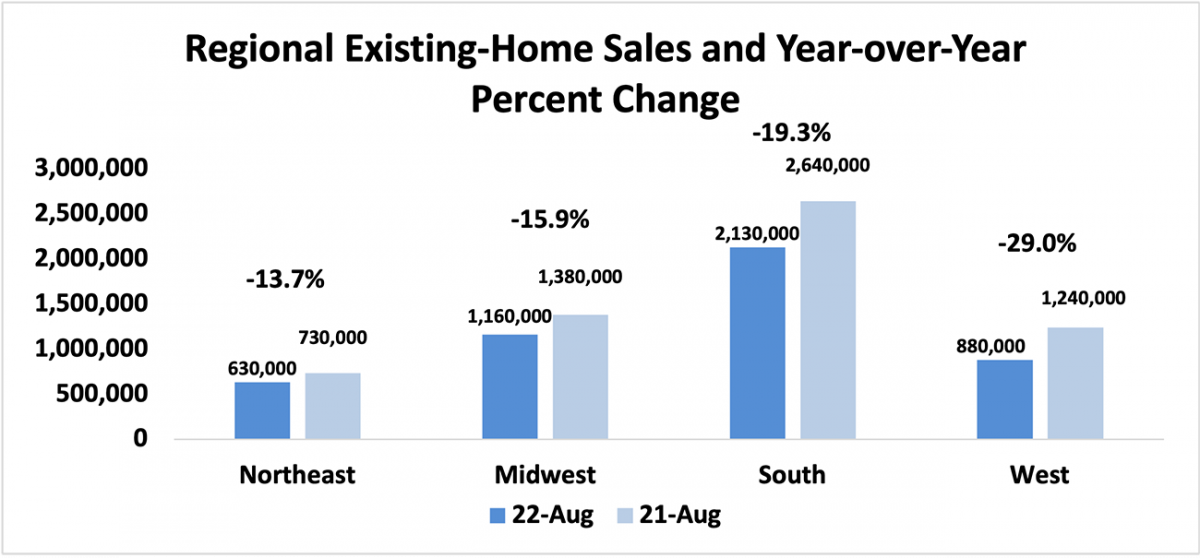

From a year ago, all of the four regions had double-digit declines in sales in August. The West had the most significant dip of 29.0%, followed by the South, which fell 19.3%. The Midwest decreased 15.9%, followed by the Northeast, which was down 13.7%.

Compared to July 2022, only the Midwest region showed a reduction in sales (3.3%) in August. The Northeast region had the most significant incline of 1.6%, followed by the West with an increase of 1.1%. The South region was flat with no change in sales.

The South led all regions in percentage of national sales, accounting for 44.4% of the total, while the Northeast had the smallest share at 13.1%.

In August, single-family sales decreased 0.9%, and condominium sales rose 4.0% compared to last month. Single-family home sales were 19.2%, while condominium sales fell 24.6% compared to a year ago. The median sales price of single-family homes rose to 7.6% at $396,300 from August 2021, while the median sales price of condominiums rose 7.8% to $333,700.