And this was during the summer rally as mortgage rates dropped to 5%, stocks bounced, the Fed “pivoted,” and the Good Times started all over again.

By Wolf Richter for WOLF STREET.

Home sales that closed in August were made somewhere from a few days to a couple of months before they closed – so roughly around and before the peak of the summer bear-market rally in mortgage rates and stocks that started in mid-June and ended in mid-August.

By mid-June, the average 30-year fixed rate mortgage was at or above 6%, having doubled in less than a year. And stocks had sunk. But then the tightening-deniers fanned out and trolled the media with nonsense about the Fed being “dovish,” that it would “pivot” in September or whatever, and they declared that inflation was “over,” etc. etc., and stocks bounced off their mid-June lows and mortgage rates fell from 6% to 5%, and for a moment just below 5%. And Realtors were already talking about how the housing market was picking up again.

Now we know that all this was a hoax. Mortgage rates are now solidly over 6%. Fed chair Powell finally got through to everyone with his Jackson Hole speech that the Fed will tighten further. Inflation got worse and has shifted to services, from where it’s difficult to dislodge. And the stock market, now finally seeing inflation and higher rates, has given up most of the bear-market rally gains.

But back then, it seemed real enough to lots of people. In the San Francisco Bay Area and in Southern California – whose housing markets are heavily dependent on the stock market – there were hopes of an uptick amid re-surging stock prices, plunging mortgage rates, and gorgeously imagined Fed pivots. Those were the Good Times. So here is what we got instead from the California Association of Realtors for August:

Prices sank further. In four of the five big Bay Area counties, prices were down year-over-year. Sales volume was dismal, though slightly less dismal than the collapse in July. Time on the market about doubled year-over-year. And supply surged year-over-year.

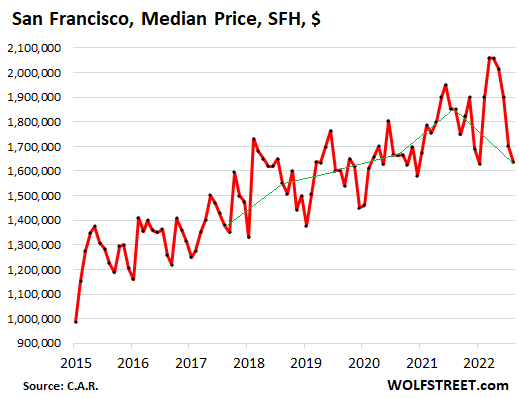

San Francisco County leads:

Sales volume, single-family houses (SFH): -24% year-over-year, slightly less dismal than -26% in July.

Median time on the market: 20 days, up from 15 days in July, and up from 11 days a year ago.

Supply of unsold inventory: 2.2 months, same as in July, compared to 1.7 months a year ago.

Median Price, single-family houses: $1.635 million, lowest price for any August since 2019 ($1.60 million): -3.8% from July, fifth month in a row of declines, -20.6% from peak in March, -11.6% year-over-year.

In San Francisco, prices usually hit their seasonal lows in January or February; so this will be interesting. The green line connects the Augusts:

These are massive price declines in San Francisco. Yes, median prices are volatile, and we look at them with a good dose of circumspection, and trends need to be confirmed over time. But this trend here is being confirmed nicely so far.

One glance at the chart tells us that the median price will eventually bounce again, to zigzag lower rather than to go to heck in a straight line.

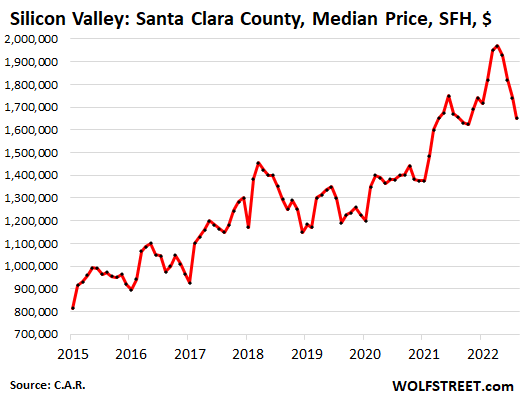

Santa Clara County, southern Silicon Valley.

Sales volume, single-family houses: -28% year-over-year, less dismal than -46% in July.

Median time on the market: 16 days, up from 14 days in July, and up from 8 days a year ago.

Supply of unsold inventory: 2.0 months, compared to 2.6 months in July, and 1.4 months a year ago.

Median Price, single-family houses, $1.65 million: -5.2% from July, fourth month in a row of declines, -15.4% from peak in April, -0.3% year-over-year:

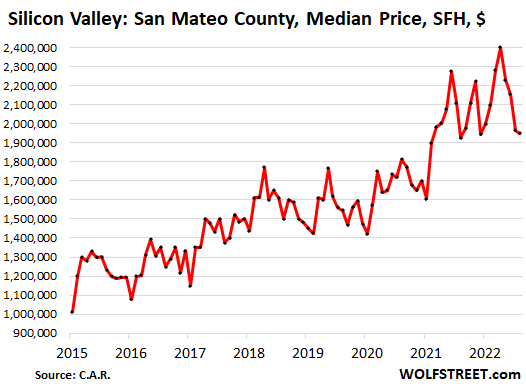

San Mateo County, northern Silicon Valley.

Sales volume, single-family houses: -30% year-over-year, slightly less dismal than -35% in July.

Median time on the market: 14 days, up from 12 days in July, and up from 9 days a year ago.

Supply of unsold inventory: 2.3 months, compared to 2.2 months in July, and 1.5 months a year ago.

Median Price, single-family houses, $1.95 million: -0.8% from July, fourth month in a row of declines, -14.5% from peak in April, +1.3% year-over-year:

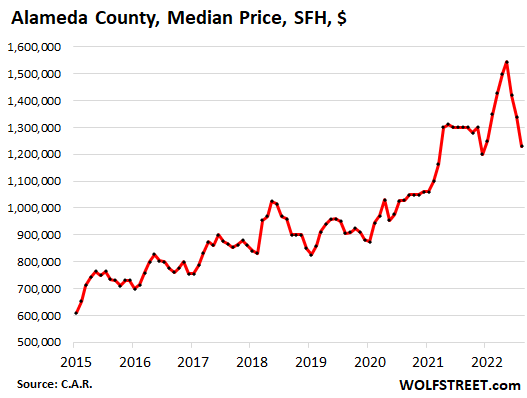

Alameda County, East Bay.

Sales volume, single-family houses: -30% year-over-year, less dismal than -35% in July.

Median time on the market: 16 days, up from 13 days in July, and up from 9 days a year ago.

Supply of unsold inventory: 2.1 months, compared to 2.4 months in July, and 1.3 months a year ago.

Median Price, single-family houses, $1.23 million: -8.2% from July, third month in a row of declines, -14% from peak in May, -5.4% year-over-year:

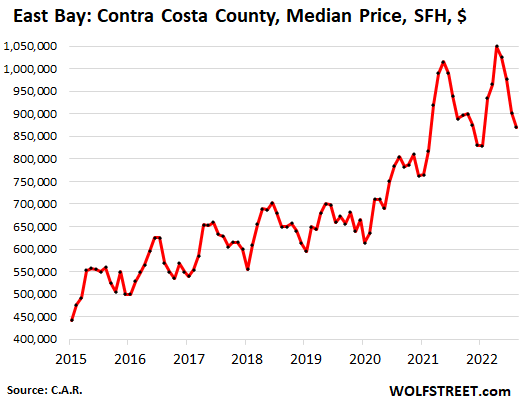

Contra Costa County, East Bay.

Sales volume, single-family houses: -27% year-over-year, less dismal than -36% in July.

Median time on the market: 18 days, up from 13 days in July, and more than double the 9 days a year ago.

Supply of unsold inventory: 2.3 months, compared to 2.5 months in July, and 1.4 months a year ago.

Median Price, single-family houses, $870,000: -3.6% from July, fourth month in a row of declines, -10% from peak in April, -2.2% year-over-year:

Southern California trying to catch up.

In Southern California overall, house prices fell for the third month in a row, -5.9% from the peak, which whittled the year-over-year gain down to 4.6%. So here are the three biggest counties. In San Diego, the median price dropped nearly 5% from July. In Orange, it dropped 2.5%, but it ticked up in Los Angeles. So here we go, starting with the most splendid housing bubble, San Diego.

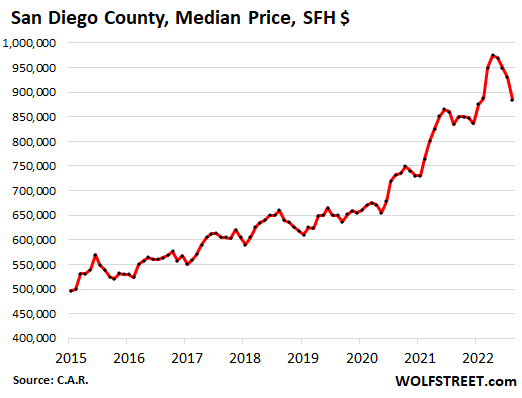

San Diego County.

Sales volume of single-family houses: -28% year-over-year, less dismal than -41% in July.

Median time on the market: 15 days, up from 10 days in July, and nearly double the 8 days a year ago.

Supply of unsold inventory: 2.5 months, compared to 3.1 months in July, and 1.7 months a year ago.

Median Price, single-family houses, $885,000: -4.8% from July, fourth month in a row of declines, -9% from peak in April, which cut the year-over-year gain to +6.0%:

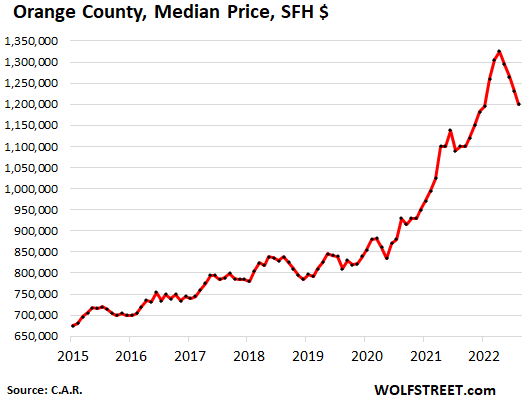

Orange County.

Sales volume of single-family houses: -30% year-over-year, less dismal than -39% in July.

Median time on the market: 17.5 days, up from 13 days in July, more than double the 8 days a year ago.

Supply of unsold inventory: 2.5 months, compared to 3.0 months in July, and 1.6 months a year ago.

Median Price, single-family houses, $1.2 million: -2.5% from July, fourth month in a row of declines, -9% from peak in April, which cut the year-over-year gain to +9.1%:

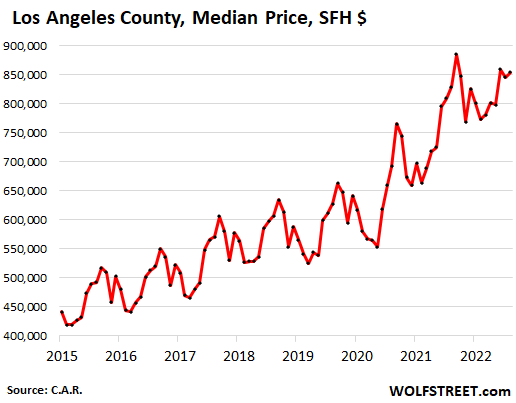

In Los Angeles County.

Sales volume of single-family houses: -29% year-over-year, slightly less dismal than -32% in July.

Median time on the market: 16 days, up from 13 days in July, nearly double the 9 days a year ago.

Supply of unsold inventory: 3.1 months, compared to 3.3 months in July, and 2.0 months a year ago.

Median Price, single-family houses, $855,000: +1.0% from July, -3.5% from peak last September, +3.0% year-over-year:

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()